‘Panama Papers’ is the Biggest Data Leak in History

‘Panama Papers’ is the Biggest Data Leak in History

A leak of 11.5m files from the database of Mossack Fonseca, the world’s fourth biggest offshore law firm, details information about more than 214,000 offshore companies listed by the firm, including the identities of company shareholders and directors. The documents illustrate how wealthy individuals, including public officials, can hide assets from public scrutiny.

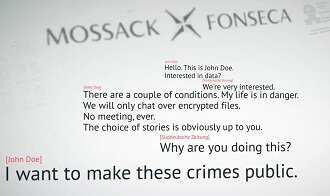

The so-called ‘Panama Papers’ were obtained from an anonymous source by the German newspaper Süddeutsche Zeitung, which shared them with the International Consortium of Investigative Journalists (ICIJ). The ICIJ then shared them with a large network of international partners.

Offshore accounts are not illegal but are often used as tax havens for money laundering and corruption. Many of these entities were reportedly found to be shell companies established in order to help several of the law firm’s clients, through more than 500 top banks worldwide, allegedly hide income and transactions worth billions of dollars.

The leak will likely have an enduring impact on taxation, regulatory and corporate governance issues around the world.

IMF chief Christine Lagarde has warned that stamping out “toxic” tax avoidance by multinational companies is likely to take years, describing tax evasion and avoidance as a “major concern” for the global economy. She said a comprehensive global agreement on how corporations should be taxed would take a long time to negotiate. The IMF has also said it is to launch an initiative with the World Bank, the OECD and United Nations intended to improve information sharing and coordination between organisations in the wake of the Panama Papers leak.

Prime Minister announces new tax evasion law

David Cameron has announced plans to make firms liable for staff facilitating tax evasion. In the light of the Panama Papers leak, he has brought forward proposals to criminalise companies whose employees abet tax crimes. HMRC says current legislation places too high a burden of proof on prosecutors to be able to punish companies for tax evasion carried out by somebody who is working for them. The measure should be written into law this year.

Those companies that fail to stop staff facilitating tax evasion could be hit with unlimited fines. HMRC has published details of regulations aimed at holding to account corporations that lack safeguards against rogue employees. But the proposal has angered banks, law firms and accountants, which argue that the clampdown will make the UK less competitive on the international stage.

The law is expected to target companies with lax supervisory mechanisms and firms which purposefully promote tax evasion.

Impact on wealth management and financial planning

There are many legitimate reasons to make use of offshore facilities. Going offshore can provide a predictable and stability legal framework for an investment into a country with an otherwise fragile legal system. Nevertheless, there is a difference between firms acting as a legitimate component of financial planning – for example, those domiciled in the Channel Islands – and those companies operating on the margins of international finance.

Attempts to further regulate and monitor offshore centres have been underway for several decades, and the offshore industry has made largely successful attempts to clean up its act.

However, the Panama Papers leak will place the issue of reputational risk at centre stage. Risk will likely become a core focus of financial planning considerations. While going offshore may indeed be wholly legitimate, those who do it will have to ask themselves how it looks to the wider world.

Panama Papers’ could change wealth protection measures for the high net-worth

For advice on issues relating to tax and estate planning, wills, trusts, and probate contact our specialist high net-worth lawyers on 01494 790002. Alternatively, please email us at estatemanagement@ibblaw.co.uk.